california renters credit turbotax

EITC reduces your California tax obligation or allows a refund if no California tax is due. Manitobas Education Property Tax Credit.

Turbotax Review 2022 Pros And Cons

Yes California has a renters credit.

. California also has an earned income tax credit. Does California - Nonrefundable Renters Credit apply to room renting. I rent a room in a house in CA.

Current state law allows a nonrefundable credit for qualified renters in the following amounts for tax year 2017. May 4 2022 at 1110 am. Widower How to claim.

I lived and payed rent in an apartment for all of 2017 and part of 2018. Attach the completed form FTB 3913 to Form 540 California Resident Income Tax Return. Some credits such as the earned income credit are refundable which means that you still receive the full amount of the credit even if the credit.

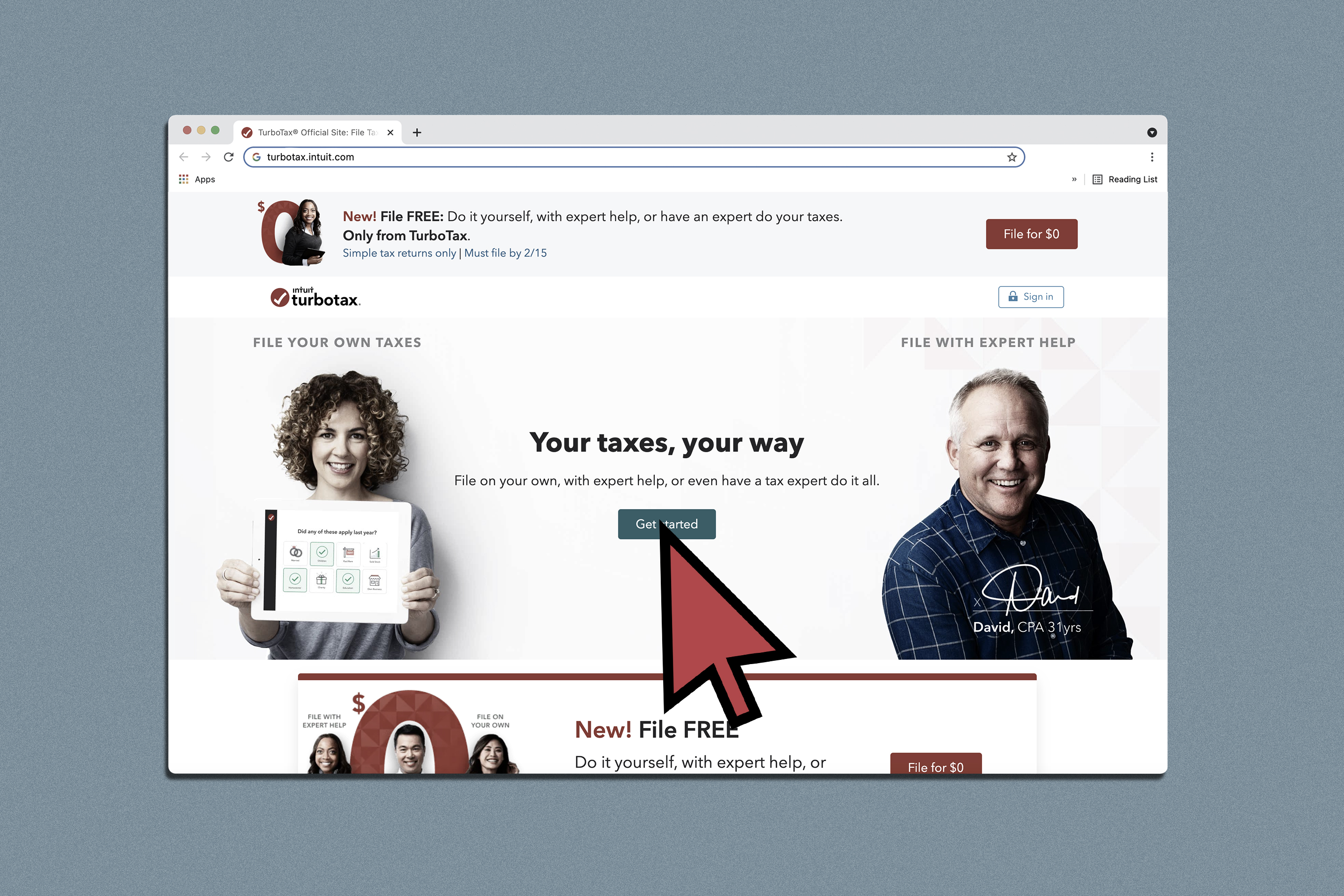

For taxable years beginning on or after January 1 2021 taxpayers should file California form FTB 3913 Moving Expense Deduction to claim moving expense deductions. Posted by 1 year ago. Ad TurboTax Tax Experts Are On Demand To Help When You Need It.

I have proof of this through the checks written out to my dad. 120 credit if your are. The refundable California Earned Income Tax Credit EITC is available to taxpayers who earned wage income in.

Residents of Manitoba who pay rent may be able to receive a credit of up to 20 of rent payments or 700 whichever is less. I am a college student filing independent. REUTERSMike BlakeFile Photo Reuters.

Renters Credit on TurboTax. California Resident Income Tax Return Form 540 line 46. I lived on a off-campus apartment and my name is on a lease so I do pay rent.

The other eligibility requirements are as follows. It just says you need to have paid rent for half the year and a couple of other things that I meet. You paid rent for a minimum of six months for your principal residence.

For more information see Schedule CA 540 instructions and get form FTB 3913. You received the California Earned Income Tax Credit CalEITC on your your 2020 tax return. Part way through 2018 I moved into a room in a house that I am now paying rent to the homeowners and I am not a member of their family so I am unsure if i can still use the Renters Credit.

TurboTax will ask you the qualifying questions determine if you qualify and calculate the credit for you. To claim the renters credit for California all of the following criteria must be met. Hawaii renters who make less than 30000 per year and pay at least 1000 in rent for their.

Under the Provincial tab select Provincial Tax Credits Profile then make sure to check the boxes Education Property Tax Credit rent paid and the next box Manitoba School Tax Credit proceed to the next screen which allows for input of your housing information. Calculate your portion of the rent only when filling out the application. California has signed the Golden State Stimulus which includes 600-1200 cash payments to eligible residents.

Posted by 1 year ago. For more information on Manitobas Education Property Tax Credit see the following links. Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your principal residence is what they asked.

California This credit is similar to the federal Earned Income Credit EIC but with different income limitations. For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops to zero. File your income tax return.

Federal law lacks a credit comparable to the states Renters Credit. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. Answer Simple Questions About Your Life And We Do The Rest.

The rent is paid my dad but my brother and me give him money. You may be eligible for one or more tax credits. I have been living in CA at the same address for the past 3 years or so.

60 for single or married filing separately with an adjusted gross income AGI of 40078 or less and. 60 credit if you are. File With TurboTax Today.

If you pay rent for your housing. To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. If you are Married Filing Joint the credit is 120.

Does California - Nonrefundable Renters Credit apply to room renting. In the California interview look for the section called Renters Credit. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident.

Use one of the following forms when filing. Nonresidents cannot claim this credit. You must be a California resident for the tax year youre claiming the renters credit.

NEW YORK Reuters - Intuit Inc agreed to pay 141. A tax credit is a dollar-for-dollar reduction of the income tax you owe. Tax credits help reduce the amount of tax you may owe.

In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively. For Single filer it is 60. Have a family with children or help provide money for low-income college students.

Get Your Taxes Done Right. I dont see anything from the IRS saying there is a limit on how many people in a household can claim this credit. An Intuit office is shown in San Diego California August 21 2015.

I was able to claim the Renters Credit on my 2017 return. California Renters Credit SOLVED by Intuit Lacerte Tax 11 Updated August 20 2021 Use Screen 53013 California Other Credits to enter information for the Renters credit.

How To File Taxes For Free Turbotax 2022 Free File Change Money

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Turbotax Refund Advance Loan Review Credit Karma

Best Tax Software Of May 2022 Forbes Advisor

Turbotax Review Forbes Advisor

I Was Almost Duped By This 40 Turbotax Fee How To Avoid It Money

Turbotax Lets You File Taxes For Free But There S A Catch Money

Turbotax Review Forbes Advisor

Turbotax Review Forbes Advisor

Turbotax Reviews 2022 Supermoney

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

4 Steps From E File To Your Tax Refund The Turbotax Blog

Homebuyer Tax Credit 7 Surprising Facts Turbotax Tax Tips Videos

10 Tax Tips For The Suddenly Unemployed Turbotax Tax Tips Videos

4 Steps From E File To Your Tax Refund The Turbotax Blog

Turbo Tax Opts Out Of Irs S Free File Program Newsnation

10 Tax Tips For Airbnb Homeaway Vrbo Vacation Rentals Turbotax Tax Tips Videos Vacation Rental Homeaway Rental

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit